AAA Finds Interest in EVs Declining

June 12, 2024

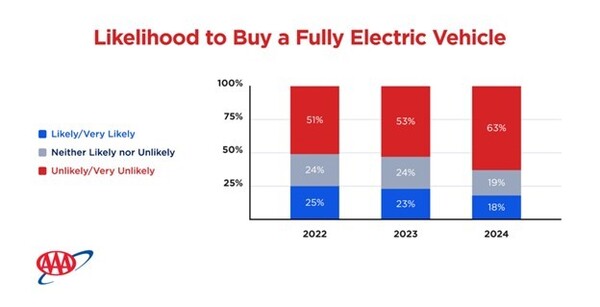

The most recent annual consumer survey by AAA on Electric Vehicles (EVs) indicates a decline in consumer interest in purchasing EVs. Only 18% of U.S. adults say they would be "very likely" or "likely" to buy a new or used EV (not a hybrid) - down from 23% last year. Even more revealing, 63% cited “unlikely or very unlikely” to purchase an EV for their next car purchase.

"Early adopters who wanted an EV already have one," said Greg Brannon, director of automotive research at AAA. "The remaining group of people who have yet to adopt EVs consider the practicality, cost, convenience, and ownership experience, and for some, those are big enough hurdles to keep them from making the jump to fully electric."

AAA found the main hesitations in purchasing an EV continue to be cost, lack of convenient charging options, and range anxiety. Three in ten also cited the inability to install a charging station where they live.

Accessible, reliable, affordable, and convenient charging is key to growing EV interest and adoption. For people who live in an apartment or condo, at-home charging options are likely not possible. An EV might be a great choice for households with 2+ cars, but it might not fit the consumer who has to rely on their car for everyday use and travel.

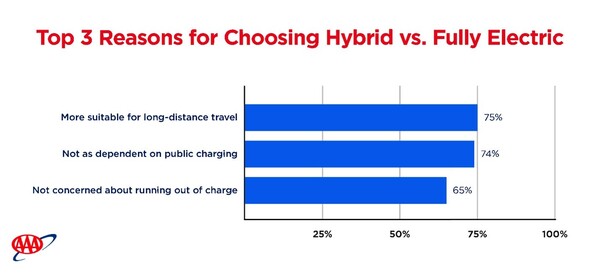

AAA believes there may be a near-term ceiling related to consumer adoption of battery electric vehicles due to their costs, charging accessibility, and range anxiety. However, hybrid options could bridge these gaps, broadening consumer interest in owning an EV. AAA’s survey also found that one in three U.S. adults (31%) say they would be “very likely” or “likely” to buy a hybrid. Access to a hybrid vehicle lessens the anxiety for consumers because it allows people to enjoy the benefits of electrification without feeling like they are disrupting their current lifestyle or travel plans (longer distance driving, less charging options, etc.).

“Deciding to make the leap to full electric may feel overwhelming for many consumers, and a hybrid option may be the way to bridge this gap,” continued Brannon. “Consumer demand will ultimately dictate the future, and my prediction is that we will have a mix of EVs, hybrids, and internal combustion vehicles in dealerships and on the roads in the US for many decades ahead.”

To help educate the public, AAA conducts ongoing research on EVs, including consumer sentiment surveys, testing to determine factors impacting electric vehicle range, the true cost of electric vehicle ownership, and a survey on consumers’ experience with going electric.

AAA has a range of resources and services for EV owners, those interested in making the switch, or those who want to try a rental.

· EV 101: Online resource for anyone interested in going electric, whether shopping for new OR used.

· The “CARBs” of Driving an EV: An acronym for 1st time EV Drivers that surveys Point of View (POV) survey from 1st time drivers on how to remember EV based driving tips.

· Your Driving Cost Calculator; An online resource available to consumers that gives a yearly breakdown of EV ownership costs

· #AdultingwithAAA: Car Care Electric Vehicles - Low Maintenance - No Problem: AAA series for young adults providing helpful tips, advice, and life hacks on all things “Adulting.”

· Mobile EV Charging Pilot & AAA EV Member Benefits: Available in select cities, this service is now part of our roadside assistance and will get EV owners back on the go if they run out of charge. That's just one of the many benefits and services we offer our EV members.

· EV Research: AAA in-house experts research consumer sentiment around EVs and their functionality.

· AAA Car Guide: For those in the market for newer used EVs, the online resources also contain links to the two prior editions in 2022 and 2023.

Methodology

The survey was conducted April 4-8, 2024, using a probability-based panel designed to be representative of the U.S. household population overall. The panel provides sample coverage of approximately 97% of the U.S. household population. Most surveys were completed online; consumers without Internet access were surveyed over the phone.

A total of 1,152 interviews were completed among U.S. adults, 18 years of age or older. The margin of error for the study overall is +/- 4% at the 95% confidence level. Smaller subgroups have larger error margins.