Study: Property Taxes & State Revenue Failed To Keep Up With Inflation

December 5, 2019

Property taxes and state revenue sharing has failed to keep up with inflation in Michigan communities according to a recently released report commissioned by the Michigan Municipal League.

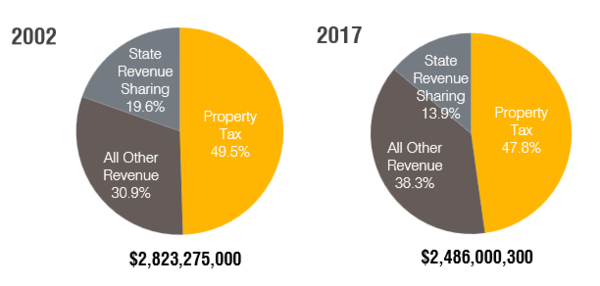

Public Sector Consultants conducted a study on growth in revenues for Michigan cities using information contained in the F-65 reports filed each year by local governments. The study, which compared reported city revenues in 2002 to the revenues reported in 2017, found that when taking inflation into account, property taxes lost 15 percent of their value, and revenue sharing from the state fell by more than 37 percent. In 2002, those two revenue sources accounted for nearly 70 percent of all city revenue. By 2017, they only accounted for 60 percent of city revenues.

The study matches the findings of an earlier report from the Southeast Michigan Council of Governments, or SEMCOG, which took a critical look at how municipalities will be funded, particularly from an infrastructure standpoint. SEMCOG’s 2017 study “By the Numbers” covered revenue growth and expenditures for all types of local governments, and compared Michigan to other states. The report looked at budgets through 2012. Michigan cities, in particular, fared very poorly as compared to the rest of the nation.

Bill Anderson, SEMCOG’s Specialist in Local Government Operations and Finance, says Michigan communities have not rebounded from the Great Recession as easily as other cities in the nation due to constitutional limitations under the Headlee Amendment, or Proposal A. Under those limitations, once property values decreased, property taxes were not allowed to exceed the rate of inflation. Anderson says, “When we hit the bottom of the recession, that became the new reality for operational budgets for cities across the state.”

Anderson feels Michigan's municipalities are now falling behind in terms of what kind of amenities people are looking for when they move to a community. He says even though they might not seem pervasive, the ramifications can be felt in Livingston County, citing situations in which area municipalities have considered and implemented civic event fees in order to continue to support festivals and other community events. That’s made budgeting difficult in local municipalities, Anderson says, as officials wrestle with funding necessary infrastructure items like roads, but also community events that make the area an attractive place to live.

Anderson says Michigan taking last place in capital outlay might not be a problem over the course of a year or two, but at some point it will impact a community’s ability to thrive in the future. Both the MML's report and "By the Numbers" can be viewed at the link and attachment below. (DK)